Overview

SPARK

Tokenomics

Explore the tokenomics of the Glob protocol, including the GLOB token's utility, distribution, and economic model.

Tokenomics

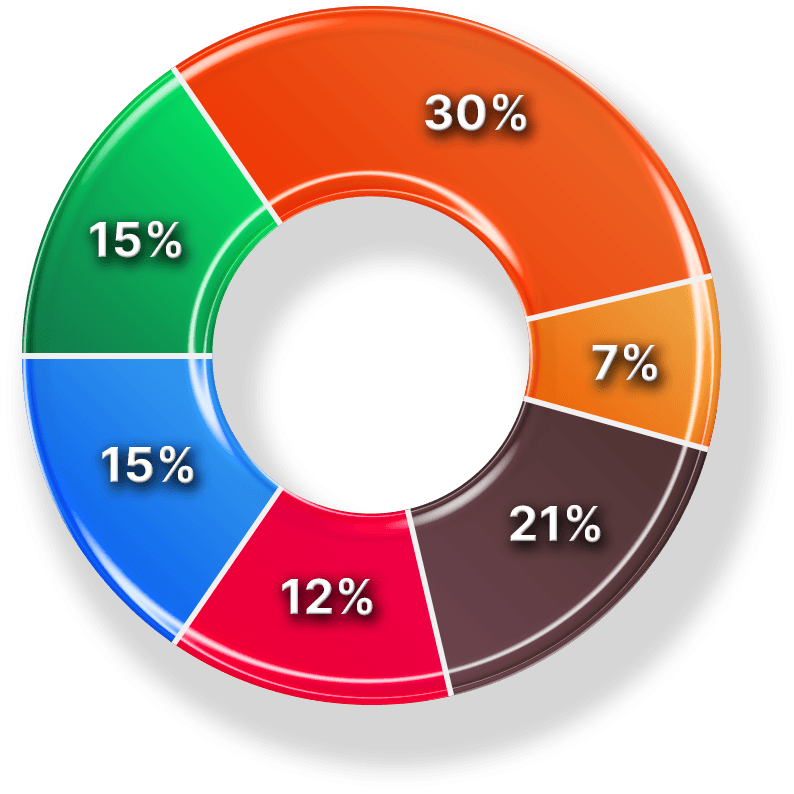

Token Allocation Breakdown

🟩 Investors – 15%

- Pre-seed and seed allocation (8% reserved for pre-seed)

- Vesting: 1-year cliff, 2-year linear vesting

- TGE Unlock: 0%

🟦 Team & Core Contributors – 15%

- Founding team and long-term technical contributors

- Vesting: 1-year cliff, 3-year linear vesting

- TGE Unlock: 0%

🟧 Ecosystem Growth – 30%

- Distribution: Node rewards (15%) + Builder grants (15%)

- Vesting: 4 years

- TGE Unlock: 0%

🟨 Community – 7%

- Selective airdrop for early testnet users and supporters

- Vesting: None

- TGE Unlock: 100%

🟥 Liquidity – 12%

- Used for DEX pools and CEX market making

- Vesting: None

- TGE Unlock: 100%

🟫 DAO & Reserve – 21%

- Governance, protocol expansion, long-term flexibility

- (13% DAO Treasury + 8% Token Reserve)

- Vesting: 6-month cliff, then 3-year linear vesting

- TGE Unlock: 0%

🟪 Initial Circulating Supply – ~19%

- Includes:

- 12% Liquidity

- 7% Community Airdrop

TGE: Token Generation Event

Roadmap

Our roadmap outlines the key phases and goals for the Glob protocol, from initial MVP to mainnet launch.

Architecture

The Glob network is a decentralized, node-powered storage layer that enables permissionless, verifiable blob data writes. Here's a high-level view of how a write request flows through the system